Writing multiple lives at the same work place or in the same association can bring the costs down for your clients—while still maintaining all of the advantages of an individual policy.

In this blog I will focus on the most common and most basic approach, writing three (or sometimes two) lives at the same place of employment. Later blogs will discuss simplified and guaranteed standard issue policies.

Offering a discount to your clients can be one of the most effective marketing tools available to you. Lower premiums in general tend to increase sales, but effective marketing of discounts can add an additional incentive to your clients to act. Everyone likes to believe that she has gotten a good deal.

In the individual disability insurance market, most cases are individually priced and underwritten. For example, a physician who applies for a policy will see rates based on his or her specialty, age, state, tobacco use and health issues if any. All of the factors that go into policy construction, including the elimination period, benefit period and riders will also affect the premium. But the cost of each of those factors has to be filed with the state insurance commission. The premium will be determined by the rates filed in that state. The premium will not fluctuate year to year as it can with Group Long Term Disability (LTD). For Non-cancellable, guaranteed renewable products, the premium will then be fixed for the life of the policy (usually to age 65 or 67—thus the stringent medical and financial underwriting up front).

The premiums for Group LTD on the other hand, are determined not only by the policy series available at the time, but also by the characteristics of the group. The larger the group, the lower the premium generally. Other factors can come into play, but because the group contract typically is renewed each year, the carrier has much more leeway to negotiate on premium for cases that they want.

Discounts in the individual market exist as well, but the rules are more clearly defined. In the past these discounts were almost always unisex rates (so women typically saw a big discount and men a smaller discount since DI policies for women cost more than for men). More recently, a number of carriers have done away with unisex rates. This trend has been especially prominent in the resident market.

Many carriers offer a 10%, 15%, or 20% (it varies by carrier) discount with as few as two or (usually) three lives. For example, Standard Insurance Company will issue a 10% gender discount on as few as two lives, when they are both owners (at least 20% ownership) and the premium is at least $5,000. Or they will offer a 10% gender distinct discount with three lives at the same place of employment.

Principal Financial Group will issue multi-life premiums that are unisex in pricing and that offer a 20% discount. For female applicants the discount can be as much as 40%!

Ameritas offers either a 15% gender distinct discount with three lives – but the discount goes up to 20% if it is employer paid or if there is 100% participation.

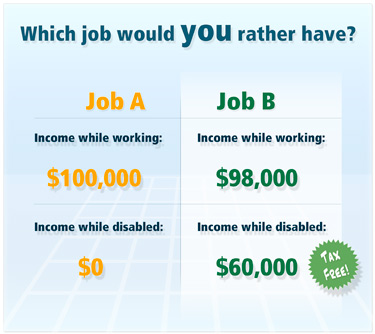

While individual disability insurance policies, even those with a discount, will almost never compete on premium with a group LTD plan, individual policies offer their own unique benefits, including, typically, better policy definitions, ease of portability, and freedom from being governed by ERISA.

Typically three cases need to be submitted together to start the discount, but there are exceptions sometimes to this rule. If one case is submitted, the other two can be added within the six months or a year depending upon the carrier. Once the discount is established, going forward new cases can be added to an existing multi-life case. Some carriers have become rather aggressive in allowing any producer to add to an existing multi-life case with the discount and other carriers are more restrictive, requiring each producer to obtain his or her three clients to get the discount.

Association discounts also exist, but are much less common than in the past. Most carriers have not have good success with association discounts, but there are some still out there. Both Principal and Ameritas, for example, still have some association discounts. They are 10%, gender distinct. To start a new one the producer would typically have to show that he or she is endorsed by the association and will have to have a marketing plan. Usually, the association discounts are limited to one state, but in our industry there are always exceptions.

In the physician resident market right now only MassMutual and Ohio National offer unisex rates on residents, but we expect that to change in the coming years. All of the other carriers who were offering unisex rates to physician residents have moved to gender distinct rates because they were receiving more female applicants than they had priced for. This market has become very competitive and has essentially developed its own rules when it comes to discounts—it is hard to write a case in that market without a discount. The discount rules for residents have changed frequently in the last few years, so best to call us if you have questions about that market.

So the next time you are discussing the need for disability insurance with a client, ask for referrals: with three (sometimes two) lives you can bring the premium down for that client and potentially generate more sales for yourself.

Read More

There I was, excitedly waiting to take a piece of candy from Mrs. Bush’s treat bag. I love candy!! Mrs. Bush was my first grade teacher and all-time favorite. Yes, my turn! I walked up to the bag, slowly peaked in, and selected what was surely the finest treat. However, my joy was soon dashed by a series of mixed emotions. The kid right after me grabbed a whole handful of candy – and got to keep it all! Why the nerve of that boy! So greedy! Why didn’t I think of that?! I will never forget that moment. Up until then, I NEVER dreamt of taking or asking for more than what was presented.

There I was, excitedly waiting to take a piece of candy from Mrs. Bush’s treat bag. I love candy!! Mrs. Bush was my first grade teacher and all-time favorite. Yes, my turn! I walked up to the bag, slowly peaked in, and selected what was surely the finest treat. However, my joy was soon dashed by a series of mixed emotions. The kid right after me grabbed a whole handful of candy – and got to keep it all! Why the nerve of that boy! So greedy! Why didn’t I think of that?! I will never forget that moment. Up until then, I NEVER dreamt of taking or asking for more than what was presented. With the launch of Standard’s new Disability Insurance product, Platinum Advantage, in 42 states next week (January 3, 2017), the discussion below of their “Family Care” benefit is timely.

With the launch of Standard’s new Disability Insurance product, Platinum Advantage, in 42 states next week (January 3, 2017), the discussion below of their “Family Care” benefit is timely.