Designing a policy for your client

The basic idea in disability insurance is to replace lost income in the event of a disability. The policies we offer are comprehensive policies. They cover disabilities whether they developed on or off of the job.

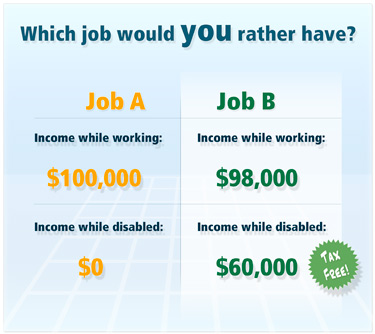

In designing the best possible policy for your client, the first thing to remember is that at the time of claim, the best policy in the world is the one that your client owns. In other words, quoting the best product on the market with all of the bells and whistles will not help at the time disability if your client does not actually buy something. So lining up your clients needs with what he or she can afford is the most critical aspect of helping your client choose a policy.

Carriers

Before we discuss the details of a designing a policy, a few words about carriers. Not all carriers have been created equally. Building a relationship with one or two carriers can be beneficial for you. You get to know their product, their processes, and their underwriters. And some carriers offer bonuses for production, particularly on renewals.

Because of the large volume of business we write, we represent most of the major carriers that offer their products outside of a captive distribution system and we know them well. We are confident that the carriers we work with pay claims fairly. We believe strongly in having good relationships with our carriers. We try our best to give them quality business, and in turn when we need extra help they do their best to accommodate us.

In choosing a carrier, certainly you want one that is financially stable and if possible large and diverse, but the difference between an A++, an A+, or an A rating with AM Best (or similar ratings with other firms) should not be your only guide. Contrary to the experience in the late 80’s and early 90’s, carriers today are finding that well managed DI blocks can provide a good rate of return on their investment.

The disability insurance market is much more mature today than it was in the ‘80’s. Underwriting is stricter than it was (but not as tough as it was a few years ago). What this means is that most of the carriers that remain in the market today are doing well financially. For those carriers for whom disability insurance is a large portion of their business, obtaining the highest ratings is difficult because of the strict reserve requirements when a client goes on claim. Thus, the AM Best rating should not be your only guideline. But at a minimum, we suggest choosing carriers with an AM Best rating of at least A- (investment grade).

Underwriting and ease of doing business are two other important considerations. Some carriers pride themselves on making good business decisions as part of the underwriting process, others seems to only read from their underwriting manuals, whether it makes business sense or not. Some carriers are quick and efficient; some are more challenging in the underwriting process, asking for details that appear less than pertinent. We can help guide your application decisions in this regard. Saving a good client from an unpleasant underwriting experience might be worth a slightly higher premium.

Lining up the policy with your client’s needs

Concerns about Disability: The first rule in your search for a policy for your client is to match the policy with your client’s needs. Some of that matching we can do for you—such as finding the carrier with the best definition and premium for a 48 year old female dentist, who is a little over weight, in Washington State. It might not be the same product we recommend for a 30 year old male dentist in excellent health in Florida. We know the market and can get you the most competitive quotes.

For your part it is helpful to get a sense of what your client’s concerns are in relation to disability. Initially their concerns are likely to be vague, if present at all, but if you have clarified the need for income protection in the event of a disability, then exploring what their idea is about how they might be disabled can be a logical next step. They might assume, as many younger people do, that accidents are the most likely cause of disabilities, or they might be very worried about a very specific type of problem, e.g. a surgeon worrying about carpet tunnel syndrome. Understanding the client’s concerns will help you to choose the right product and to create a context to explain how the policy would protect him or her.

Premium: Gaining of sense of what your client can afford is an essential part of the process. Discussions about premium nearly always enter into the sales process for disability income insurance. Frequently, we find ourselves quoting two or three carriers whose policies provisions are broadly similar—e.g. one is slightly better in terms of its own occupation definition, while a second one has broader coverage of psychiatric illnesses, while a third might offer slightly more benefit or might have a better recovery definition. In such cases, premium often ends up being one of the important determining factors.

We tell agents to expect for the premium to be between 1.5% and 3% of income for a good policy. Specific factors can make it even more expensive than this, e.g. an older female who is overweight and works in a blue collar field could see premiums of over 6% of her income if the policy had a “to age 65” benefit, residual and cost of living protection. We have found that quotes above the 3% of income range rarely sell, however.

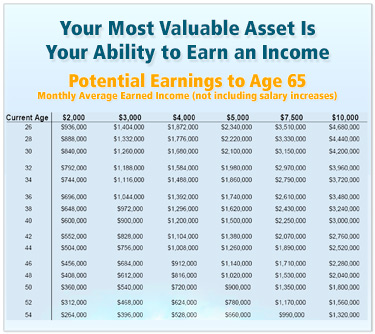

Benefit amount

Once you have a handle on what the client’s concerns about disability and their general financial picture, the next step is to find out how much coverage they need. Going through a list of the client’s monthly expenses is a great way to do this. For most clients, unless they have saved a lot, we normally quote the maximum benefit amount for which they are eligible. Typically, this means a 40% or greater cut in income while on claim. Thus, getting them the maximum benefit is usually a key aspect of designing a policy.

The next key issue to consider—some would argue it is the key issue—is the definition of disability. Our general philosophy is to always protect the client in his or her occupation for as long is available. We never want a carrier forcing someone who is disabled from his or her job to have to look for a job in a different occupation, if it can be avoided.

The definition of disability

The next key issue to consider—some would argue it is the key issue—is the definition of disability. Our general philosophy is to always protect the client in his or her occupation for as long is available. We never want a carrier forcing someone who is disabled from his or her job to have to look for a job in a different occupation, if it can be avoided.

For most occupations, however, we do not recommend the “true own occupation” definition. For the vast majority of occupations, if someone becomes disabled and returns to work, it is the occupation they had before becoming disabled. Few people choose to work in a different occupation, so why pay extra for a benefit that is so rarely used? Our recommendation for most occupations is an “own occupation and not working.”

The exception to this recommendation is for those occupations for which very specific skills are needed, such as a surgeon, a dentist or a trial attorney. For each of these occupations it is rather easy to imagine someone being disabled from that occupation, while being quite capable of fulfilling the duties of another occupation. For example, a surgeon who develops carpal tunnel syndrome and who can no longer perform surgery might well choose to teach or even to become a financial planner. In this situation, the added protection that a true own occupation definition provides makes more sense.

Benefit Period

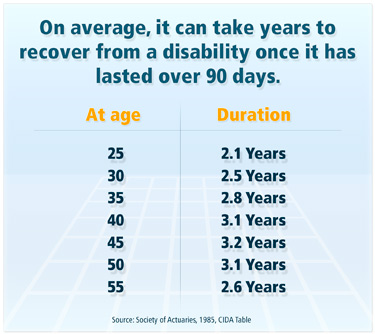

While choosing the benefit period might seem obvious, it often becomes an important part of the discussion. Most disability claims last five years or less, so whenever possible we encourage a benefit period for of at least years. In fact, if the premium is affordable, we strongly recommend a “to age 65” or “to age 67” benefit period.

If most claims last five years or less, why the recommendation for the longer benefit period? Disability coverage is about insuring the client’s income and thus their lifestyle in the event of an unexpected sickness or injury. It is not an investment, but rather protection from the downside. On average, your clients would save a little money and most would be ok with a five year benefit period, but what happens to those unlucky ones who have a long term disability? In our opinion, most of the time, the savings gained by the shorter benefit period do not offset the added risk for a given individual. Of course there are always exceptions, premium, age, and health status all play roles here, but our general recommendation is to buy a benefit period that lines up with the client’s expected retirement age.

For some clients, however, the “to age 65/67” period does not line up with their expectations for how long they will work or for how much protections they want. While a true lifetime benefit is no longer available, two carriers offer a graded lifetime benefit and some carriers offer a benefit period to age 70. Several carriers now also offer retirement protection policies which are designed to replace lost savings for retirement. We can help you decide which of these alternatives makes the most sense for your client.

Elimination Period

Most of the policies that come through our office, and we see quite a few, have an elimination period of 90 days. Simply put the carriers tend to price their products so that you get the most bang for you buck at 90 days. Shorter elimination periods, such as 60 days, often cost as much as 50% more than a policy with a 90 elimination period. Policies with 90 day elimination periods save the carries from dealing with a number of short-term claims that would drive up their processing expenses.

For most individuals, 120 days (they will be paid the month after satisfying the elimination period) is a long time to go without a paycheck. The next choice after 90 days is a 180 elimination period. Having an elimination period of 180 days would be financially devastating for many Americans, however. If a client has saved enough to self-insure for seven months, then the 180 elimination period can make sense. It usually saves them about 10% of the premium.

Those clients with more room in their budgets for insurance buy critical illness policies to provide them with immediate cash to help offset the lost of income during the elimination period—but these policies only cover on a set of specific illnesses. They are not a true replacement for a comprehensive disability insurance policy.

Riders

The description of specific riders can be found in the glossary section. To round out a solid basic policy, we strongly recommend both the residual and the purchase option riders.

So many claims become residual (partial) claims at some point in the course of a disability, that this rider is nearly essential. As medical technology improves, it will become even more and more important to have residual protection. Many of the diseases and injuries that once would have killed us now disable us. And many disabilities that once would have been long term are now short to medium term. Residual coverage offers a bridge to recovery or to a total claim.

The purchase option rider is usually relatively inexpensive (one carrier builds the cost in to the policy), and allows the client to buy more coverage in the future as his or her income rises, without medical underwriting. This rider simplifies future sales, which is good for both you and the client. Purchase option dates give you a good reason to call on a good client. It is often an easy sale since the premium increases are usually small and the process is uncomplicated. And it can lead to reviewing other aspects of his or her insurance needs.

Cost of living and catastrophic illness riders make for richer policies, but are usually the place to start cutting if premium is an issue. The younger the client, the more important a cost of living riding is. A 30 year old client, for example, could be on claim for 37 years. Even in a low inflation environment, there will be a significant loss of purchasing power over that many years. On the other hand, the benefit amount is not adjusted until the client has been on claim for a full year and since most claims last five years or less, for most claims, the cost living rider will not have a significant impact.

The catastrophic illness rider allows the client to replace up to 100% of his or her income in many circumstances, and so is a welcome addition to the list of riders. Relatively few claims will qualify for this additional amount, however, since significant help with two out of six activities of daily is required for the rider’s extra payments to kick in. So along with the cost of living rider, it usually one of the first places we look to save premium if necessary.

In summary, the basic, very solid policy we recommend begins with the maximum benefit amount, a “to age 65/67” benefit period, protection in the client’s occupation, a 90 day elimination period, and the residual and purchase option riders. True own occupation, cost of living and catastrophic illness riders all have their place, but are not essential, in our opinion, to every policy. Of course each case is specific, so any one of the recommendations may not make sense for your specific client. But we will customize each and every quote for your client’s specific needs.

Read More